All Categories

Featured

Table of Contents

We aren't simply speaking about commemorating Harmony week annually; the varying experiences, perspectives, abilities and backgrounds of our home loan brokers allows us to: Have a much better interpersonal partnership, better connections with and understanding of the demands of consumers. For one, it makes us subtly aware of the various cultural subtleties.

Besides, what we have actually seen is that generally, it's the older generation that favors to talk with a person that speaks their language, despite the fact that they might have remained in the nation for a long time. Maybe a cultural thing or a language barrier. And we recognize that! Regardless, every Australian demands to be 100% clear when making one of the greatest decisions in their life that is purchasing their first home/property.

Expert Residential Mortgage Near Me

For us, it's not just concerning the home mortgage. Most importantly, the home loan is a means to an end, so we make sure that the home mortgage is fit to your particular demands and goals. In order to do this, we understand and keep ourselves updated on the borrowing policies of almost 40 lenders and the plan exemptions that can obtain an application approved.

This lines up flawlessly with our target markets which include non-residents, freelance, unusual work, impaired debt, low deposit (loan eligibility), and other locations where good clients are allow down by the financial institutions. In verdict, we have systems in position which are carefully examined and refined not to let any person down. A frequently forgotten yet essential aspect when choosing a mortgage broker is domain expertise, i.e.

To speak with talk of the best mortgage ideal in Sydney, offer us a phone call on or fill up in our short online assessment kind.

Fast Home Loan Comparison

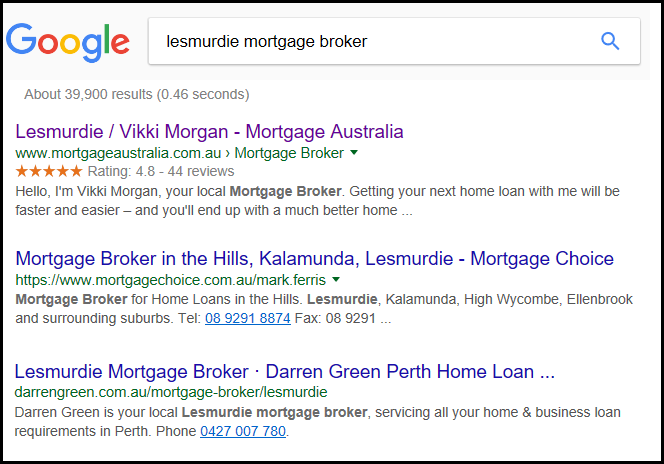

We address a few of one of the most generally asked inquiries concerning accessing home mortgage brokers in Perth. The duty of Perth home loan brokers is to provide mortgage financing options for their consumers, utilising their local market knowledge and experience. Perth home mortgage brokers, such as our team at Lendstreet, satisfaction themselves on finding the best home mortgage loaning option for your Perth residential or commercial property purchase while guiding you with the entire procedure.

There are a great deal of mortgage brokers in Perth. Here are 10 good factors to consider me most importantly the others. All missed telephone calls will certainly be returned within 4 company hours All emails got prior to 5pm will certainly be replied to in the exact same day Authorised debt representative (CRN: 480368) of AFG (ACL: 389087) Member of the Mortgage & Finance Organization of Australia (577975) Member of the Australian Financial Complaints Authority or AFCA (52529) BSc Economics from the London Institution of Business Economics Diploma of Money and Mortgage Broking Administration Certification IV in Financing and Home Loan Broking Component of a WA owned and operated business whose emphasis is entirely on the Perth market.

Over 1400 products, from even more than 30 lending institutions to pick from. Our relationship does not end with the negotiation of your lending.

Value Interest-only Mortgage Near Me – [:uarea]

All information provided is held in the most strict self-confidence and is managed according to the 1988 Personal privacy Act.

In our experience as licenced home loan brokers, we can take the stress of mortgage comparison. We contrast products from over 30+ lenders from the large banks to the tiny loan providers. We make use of only the very best and user friendly comparing devices to pinpoint the very best proprietor occupied or financial investment finance for you.

This isn't constantly the instance. Reduced rate of interest can feature extra charges or lending institution limitations. This as a matter of fact can make the funding product a lot more costly in the lasting. The majority of financial institutions will certainly sway borrowers by showing just the advertised rates of interest without factoring in elements that add onto your financing settlements.

Honest Mortgage Rates Near Me

With a lot information around, finding the most effective mortgage prices that finest fit your monetary scenario can be a tough feat. It's our job to offer you with complete product comparisons, including all the surprise costs and charges to make sure that you contrast any home mortgage product as properly as possible.

Our home loan brokers have a collective 20+ years experience in the market, are fully mindful of the patterns for the Perth market making us experts for the task. By offering a comparison tool that can assist you in making a far better monetary decision, we're encouraging consumers and enlightening them along the method.

Best Property Financing – Eden Hill 6054 WA

All you require to do is provide us a telephone call..

I serve as the liaison between you and the lending institution, ensuring a smooth and effective procedure, and conserving you the stress and anxiety. With nearly 2 decades in the mortgage industry, I supply comprehensive suggestions on all aspects of home mortgage financing. Whether you're considering the benefits of a fixed-rate vs. an adjustable-rate home loan or worried regarding car loan features and charges, I'm below to give clarity and assistance.

My substantial experience and partnerships within the industry permit me to protect much better passion rates and possibly also obtain particular fees waived for you. To summarize the above, the benefits of making use of the services of a home mortgage broker such as myself include: My links can open up doors to car loan choices you might not discover on your own, customized to your unique circumstance.

Strategic Mortgage Terms

When you pick a suitable lending early, you'll hardly ever have to fret about whether or not you can still afford it when prices boost and you'll have an easier time managing your regular monthly payments. Option is the biggest advantage that a home loan broker can supply you with (mortgage terms). The reason is that they have connections with a variety of loan providers that include financial institutions, constructing societies, and credit report unions

In general, the sooner you function with a home mortgage broker, the better. That's since functioning with one will certainly enable you to do even more in less time and get access to much better deals you possibly will not locate on your own. Of training course you likewise have to be discerning with the home loan broker that you pick to make use of.

Other than that, guarantee that they are licensed - property financing. It might additionally be useful to get referrals from individuals you trust on brokers they have actually used in the past

A home loan broker is a financial specialist who is experts in home and investment funding financing. They link customers with possible loan providers and assist facilitate the whole process. When you attach with an accredited economic broker for a home mortgage or investment lending demand, they will rest with you to recognize your certain economic demands and obtaining ability and help you protect an ideal financing at a market leading interest rate.

High-Quality Debt-to-income Ratio Near Me – Eden Hill WA

We don't rely on using an one time solution yet goal to support a relied on relationship that you can count on over and over again. We recognize that every customer has distinct demands, for that reason, we aim to supply custom mortgage remedies that finest align with your preferences every time. With an impressive track document of pleased clients and hundreds of sustained favorable Google reviews as social proof, we are the leading group you require to count on for searching for and safeguarding your following mortgage financing authorization in Perth.

Latest Posts

Transparent Residential Mortgage (Warnbro WA)

Affordable Rates Residential Mortgage

Expert Pre-approval Near Me (Perth)